E-commerce logistics: What is FIFO and how to work with it

Proper inventory management is one of the main prerequisites for a successful e-commerce business. It can have a big impact on your cash flow as well as your sales. And understanding the concept of FIFO plays a significant role here.

In an ideal world, the demand for your products is constant over time, your supply chain delivers on time, products are produced in the quality you want, according to your needs, etc. At some point, however, you will find that this is often a distant reality. Especially nowadays, when we are witnessing rising inflation, which you will feel from your suppliers the moment you decide to replenish your stock.

How to deal with these price fluctuations / increases? How should you approach storage and other handling of goods, including monitoring the accounting value of your inventory?

In practice, several methods are used, with the most common FIFO method. And as the lines above suggest, it is important to look at it from both a logistical and financial perspective.

What does FIFO mean? How to calculate it? What are other methods? Or which option to choose for your business? Find out all this in our article, in which we will put everything into concrete examples.

What is the FIFO method

The abbreviation FIFO comes from First In First Out. It is a method of material flow and inventory management in which the oldest, i.e. the earliest stocked, pieces of product are always picked from shelves.

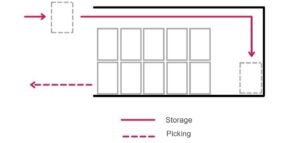

In practice, newly stocked products are placed on the shelves behind previously received items. When an order is received, the product that is at the front of the stock position is picked. This is the most commonly used method. To give you an idea, the following picture demonstrates the simplified handling of goods using this method.

Pic. 1: Inventory product handling on a shelf using the FIFO method (profile view of the stock position)

This method is particularly useful for online stores that sell products with expiry dates or products that are perishable or tend to become obsolete. By constantly rotating products in this way, you eliminate the risk of unnecessary financial losses.

Note: An analogy is the FEFO method, from First Expired First Out. When using this method, the expiration date of products is taken into account – the earliest picked item is the one with the closest expiration date. This does not take into account the stocking date or necessarily the closest stock location of a particular SKU. It is particularly used in fresh food warehouses or in the pharmaceutical industry, where ignoring expiration dates would result in particularly high economic losses.

How to work with the FIFO method in accounting

In accounting, the total residual value of inventories must be valued at the end of each accounting period or fiscal year. In this context, the so-called direct cost of goods sold (COGS) is also calculated.

As noted earlier, the cost of goods purchased varies over time; in practice, products purchased later are generally more expensive. If you work with the FIFO method, where you sell older items of lower value first, the final inventory is worth more.

The FIFO method is therefore used for the financial representation of inventories in addition to warehouse handling itself. In addition, it offers a simple formula for calculating stock balance values.

By calculating inventory values, you are also able to monitor and regulate the quality of your supply chain, optimize cash flow or eliminate the risk of high storage costs, which often involve products that are obsolete or no longer marketable.

Note: Try to generate as much profit as possible. The cost of inventory that you are unable to sell negatively affects your cash flow. In addition, some fulfillment companies charge higher costs for stocking low-turnover items. This applies, for example, to products that are in stock for more than 180 / 365 days. In this way, 3PL companies try to incentivize their clients to sell and optimize their warehousing.

ATTENTION: The correct direct cost of goods sold must be updated and recorded at all times. For example, if these costs triple in a short period of time but the accountant uses outdated values in the calculations, your final profit will be reduced.

So how does the FIFO method calculate the direct cost of goods sold when its level fluctuates over time?

FIFO method and valuation of inventories

When calculating the direct cost of goods sold (COGS) for the FIFO method, you always first calculate the cost price for previously purchased units of a particular product (because you always pick the oldest units during warehouse handling). And you multiply this unit purchase price by the number of units sold.

Example 1:

A sports nutrition company purchased 500 protein bars at the beginning of the year, paying the supplier EUR 0.40 for 1 bar. In 2 months, the company had to buy another 700 pieces, but at a higher price – 1 piece now cost EUR 0.47.

- The company bought a total of 1,200 protein bars.

- However, it has already sold 800 of these bars.

The total direct cost of goods sold (COGS; 800 pcs) is therefore:

- COGS = (number of units sold from 1st batch * purchase price of 1 unit) + (number of units sold from 2nd batch * purchase price of 1 unit)

- COGS = (500 pcs * EUR 0.4) + (300 pcs * EUR 0.47) = EUR 341

The total value of the remaining stock in stock is then calculated as follows:

- Final inventory value = remaining pieces * purchase price of 1 piece

- Final stock value = 400 pieces * EUR 0.47 = EUR 188

Example 2:

An online store with baby goods sells baby milk. On 1 January 2021, it had 40 units in stock with a purchase price of EUR 7.91. During the year, it bought two more batches, namely in February 150 pcs at a unit price of EUR 8.70, and in July 200 pcs, when 1 pcs already cost EUR 9.89. During the year he sold a total of 300 units of this baby milk. This left 90 units in stock at the end of the year.

- COGS = (40 pcs * EUR 7.91) + (150 pcs * EUR 8.70) + (110 pcs * EUR 9.89) = EUR 2709.3

- Final inventory value = 90 pcs * EUR 9.89 = EUR 890.1

LIFO and other methods of material flow and inventory management

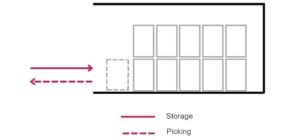

In addition to the FIFO method, there is also the LIFO method, generally used in the USA. The abbreviation LIFO comes from Last In First Out, and as the name suggests, the earliest goods to be picked for orders are those that have been stocked at the latest. Thus the opposite of the FIFO method, see image below.

Pic. 2: Inventory product handling on a shelf using the LIFO method (profile view of the stock position)

This method is suitable for oversized, heavy or difficult to handle goods. For example, if you are storing coal in 25kg bags, it would be highly inefficient to pick the stacked pieces first, which are stored underneath the storage position, and then rearrange everything. However, companies selling this type of product need to be mindful of the obsolescence of the originally stacked pieces.

From an accounting point of view, however, the LIFO method is not permitted by law in the Czech Republic. This is because prices rise during periods of inflation, when it is assumed that the latest delivery will also be the most expensive. The valuation would thus be higher than under the FIFO method and thus have a more significant impact on the tax base.

Note: Reporting higher inventory costs, as in the LIFO method, reduces the company’s final profit. U.S. companies also routinely use a combination of these methods – LIFO for inventory operations and FIFO for accounting.

For interest and to complete the picture, we also offer other well-known methods:

- FEMAL (First Expiry Minimum Available Lifetime) is similar to the FEFO method, however, in addition to the shortest expiration date, the expiration period that suits the customer and its specified limits is also taken into account.

- FESAL (First Expiry Shortest Ambient Lifetime) is a modified version of the FEMAL method, where the expiry date is updated based on the previous handling of a particular product (e.g. taking into account temperature chain breaks).

- HIFO (Highest In First Out) works on the principle of picking the most expensive piece of a particular product first to reduce the accounting value of inventory (rare, not recommended).

- LOFO (Lowest In First Out) is the opposite of HIFO, the cheapest piece of a particular product is picked in priority to increase the accounting value of inventory (theoretical, not recommended).

- The “First In” method is not really a method, but a common practice in the case of neglected inventory management. Simply put, it is picking the piece of a particular product that is encountered at hand first.

Which method of material and inventory flow to choose?

Everything needs to be checked with your accountant first and the choice of method is also influenced by your line of business, however, for inventory valuation purposes we generally recommend the FIFO method. This method follows the natural flow of inventory, simplifies the calculation of final accounting values, provides the most accurate figures, facilitates record keeping or assists in setting appropriate retail prices with the required margin.

For retailers whose products are subject to expiry dates, we recommend the FEFO method because of the minimal losses caused by expired products.

Technology, reliability, professionalism… that’s Skladon

At Skladon, we have developed our own application MySkladon, which is designed for both fast-growing online stores and long-established major e-commerce players.

“With outsourced logistics, it doesn’t matter if you have 100 or 10,000 orders a day. When the process is set up correctly, it is always possible to ship orders without major problems,” Tomas Pokorny, Co-Founder Dogsie.

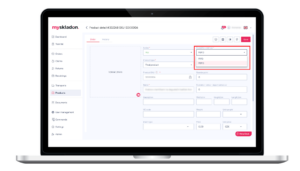

In the app, it is possible to set both the option for FIFO and FEFO methods for products. The system then monitors and ensures that orders are processed according to the set conditions.

Fig. 3: Defining the FIFO / FEFO method in the MySkladon client application

If a client chooses the FIFO method and their product is stored in multiple warehouse positions, our warehouse staff is systematically guided to pick it by the so-called optimal route, i.e. the system navigates the worker to the nearest position. In this way, the shortest time in order processing is achieved. Therefore, we are able to guarantee the dispatch of all received orders to all our clients by 12:00 the same day.

“If you find that the demand for your products is growing rapidly and you are not sure whether you can ship everything on time, do not hesitate to contact an expert in outsourcing logistics, which Skladon undoubtedly is,” Lucie Konecna, COO nanoSPACE.

The FEFO option guides warehouse operators to pick those products with the closest expiry date. Again, according to the optimal route to ensure fast picking. In this case the stocking date is suppressed, the important thing is to minimize the possible financial losses due to expiry.

MySkladon in a nutshell offers up-to-date information about your logistics. 24/7, online and on any device with an internet connection. It has built-in tools for inventory management, resulting in a number of benefits for our clients. For example, they have access:

- Real-time information on their current stock, orders, returns, returns, receipts, etc.

- Easily manage and update their SKUs

- View sales trends for inventory planning

- And much more

“I see the greatest added value in the MySkladon client application in the accurate information about our inventory and details of individual orders,” Simona Benkova, Process Manager Skinners.

With this visibility, our clients are able to optimise their stock levels, reduce storage costs and at the same time largely avoid the risk of stock outs.

For example, our application is able to answer questions such as “when to order a specific product” or “how many units to order“. It will introduce order into your supply chain and operations, ultimately resulting in a better customer experience with your online store.

Hand over inventory management and optimization to professionals

Proper inventory management is on the one hand a complex task, on the other hand it is essential for building and expanding your online store.

At Skladon, we help our clients grow – on average 156% per client in the last year. And that’s only because of their decision to put logistics in our hands. This gives them time for other development areas of their business, rather than dealing with the day-to-day logistics operations or finding optimization paths with their own logistics solution. They have benefited from our know-how, investments in systems or equipment, the savings offered on warehouse space or packaging material, volume discounts on transport or the infrastructure already in place. They have thus gained a competitive logistics advantage in their respective sectors.

“I can recommend Skladon for their professionalism and excellent technological background. I can’t imagine doing business without an external fulfillment partner anymore,” Vit Libovicky, Mementerra.

In other words, by cooperating with Skladon, you are expanding your team with experienced logistics professionals on the basis of a long-term partnership.

“The biggest change I feel in the company is that I haven’t heard about logistics since we started cooperating with Skladon.” Jakub Novak, CEO Kilpi.