Introduction to marketplaces: Tool for expansion abroad

Marketplaces are an increasingly popular topic on the Czech e-commerce scene. The power of this sales channel, which has already conquered the USA, Asia and more mature Western markets in Europe, is also growing in the Czech Republic.

What does the term marketplaces mean, which ones are the world and Czech leaders, what do domestic e-shops perceive as the biggest motivators and blockers for selling on this channel, or why do they enjoy such great popularity with customers? Find the answers in our article.

What marketplaces are

A marketplace is an online sales channel whose business model is based on offering products from different sellers under specific conditions. This means that marketplaces operators do not need to own any stock, they only facilitate sales to cooperating companies. This gives shoppers the opportunity to easily compare and choose from goods from multiple sellers in one place.

These marketplaces can look like e-shops from a layman’s point of view, as Petr Husek, Team leader from Heureka, commented during the Eshopista conference: “A lot of customers don’t even know they are actually shopping on a marketplace. They prefer this channel because of its convenience and simplicity in shopping.”

Source: Homepage Amazon

Leaders in the world of marketplaces

There are around 150 online marketplaces worldwide, among which Amazon has long been the most visited, adding 2 more markets (Egypt and Poland) in 2021, bringing it to 20 local marketplaces. The second place is taken by eBay, followed by, for example, the well-known AliExpress or Allegro in the Czech Republic (see Chart 1).

Chart 1: Leading global marketplaces by monthly number of visits (in millions)

Source: Statista

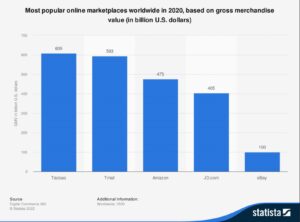

In terms of turnover size (GMV = Gross Merchandise Value), China’s Taobao and Tmall were the leading platforms in 2020, followed by Amazon (see Chart 2).

Interesting fact: Up to 63% of marketplace shoppers say they always check the price on Amazon before making a final purchase.

Chart 2: Top global marketplaces by gross merchandise value (2020, USD billion)

Source: Statista

In Europe, which is the third largest market in the world, there are a number of marketplaces that vary considerably in the range of products offered. The largest European marketplaces include Amazon Germany, Otto, Yatego, Zalando and Kaufland.de from Germany, La Redoute from France, Bol and Wehkamp from the Netherlands, Allegro from Poland, eMAG from Romania and Not On The High Street (NOTHS) from the UK. The best known domestic players are Alza.cz and Heureka. Just for comparison, the largest Czech marketplace Alza.cz accounts for about 3% of Amazon’s turnover.

Globally, marketplaces account for 60-70% of e-commerce turnover. Marketplace Pulse research shows that over 2,000 new sellers are joining Amazon’s global network every day since 2016. On the Etsy marketplace even twice as many, on eBay even more. Figuratively, the world of marketplaces could be expressed as a loop of “more sellers – more competition – lower prices – more customers”.

According to a recent Acomware survey of 50 Czech retailers, respondents said that the marketplaces channel brings them about 10% of their total turnover. “In the U.S., marketplaces account for 40% of companies’ sales, in Germany, Amazon’s share is up to 52%. From this I assume a close and significant increase for Czech online players,” Dusan Smoljak, Head of Consulting Acomware.

Main customer preferences for buying on marketplaces

There are roughly 3 billion monthly active visitors to marketplaces, with up to 49% of product searches starting (and often ending) on Amazon. These are numbers that clearly demonstrate the power of marketplaces. Why is this channel so popular?

Simplicity and convenience. The marketplaces user experience is customer-friendly in its clarity, efficiency and standardization. Shopping on marketplaces is literally a few clicks away.

Feeling safe and secure. Marketplaces are online authorities that guarantee their visitors to buy from verified sellers based on algorithms, which leads customers to feel safe shopping.

A wide range of products. By collecting offers from multiple sellers and categorizing them according to product characteristics, marketplaces are a tool for customers to compare and find the optimal product option in terms of price – quality – speed of delivery.

One account. A single login is all a customer needs to make a purchase on the marketplace. This avoids the constant repetitive registrations on single-page e-shopping portals.

Customer support. By selling on marketplaces, sellers (un)consciously commit to quality customer care. With the accumulation of negative customer reviews, they are penalized, in other words, they gradually drop in search results to “invisible” positions. Therefore, global customers need to be treated as local customers as well.

Motivators and barriers to selling on marketplaces

What are the most common arguments that play a role for online store owners when deciding to enter the marketplaces? Let’s take a closer look at both sides.

Motivators

Acquiring new customers. “Sell where your customers are.” Marketplaces are populated by users who for the vast majority have not visited and have no idea about a retailer’s e-store, yet their product appeals to them. On marketplaces, the product being sold reaches a huge audience.

Increased sales. Closely related to the first point. Selling on marketplaces diversifies the sales strategy, successful implementation can significantly increase company sales.

Increase brand/online store awareness. Brand visibility on marketplaces is an excellent tool for increasing traffic to a merchant’s e-store. This creates an interesting opportunity to establish other marketing activities such as remarketing to new audiences, etc. “We think of marketplaces as a channel that helps us scale our brand across markets in Europe,” Jan Penkala, Performance and expansion manager at Astratex.

Ease of entry into foreign/global markets. Often a key argument. Through marketplaces, the seller is given relatively easy and affordable entry into foreign markets. Tomas Rais from Auto Hotarek evaluates his experience by saying: “The investment to start selling is much lower at the beginning than going abroad with your own online store or even physically.”

Marketing promotion. Marketplaces operators invest in their marketing tactics (remarketing or banner advertising) to increase traffic to their own platforms. In other words, they market to attract potential customers to the merchant’s products.

Increase trust. By gaining visibility on marketplaces, a retailer gains trust in the eyes of shoppers. The power of authority in the form of the marketplaces operator can thus further profile the seller as a reliable and verified company.

Diversification of sales channels. Sudden global events like COVID-19 or the continuous year-on-year growth of e-commerce. These are two major reasons for selling on marketplaces. By entering the marketplaces and the related diversification, merchants achieve greater business stability or further growth. The previously mentioned Acomware survey also mapped the share of marketplaces usage among Czech retailers:

- 34% of Czech merchants currently sell on marketplaces.

- 63% of respondents are not currently selling, however 59% of them will start using this channel within 1 year at most.

- Only 3% of the respondents have decided to stop selling on marketplaces.

In other words, it is safer to sit on a business chair with four legs than on a stable-looking chair with only one leg.

Protection from competition. More of a temporary motivator. Now Czech e-commerce is in a situation where entering the marketplaces can help the seller’s business. In the short term, however, this situation is likely to change radically. “The Czech e-commerce market will change fundamentally in the next two years. The Polish group Allegro plans to acquire MALL.CZ, which will bring half of the Polish e-commerce market to the Czech Republic. If we add the plans of the German Kaufland.de to the Czech market, the Czech online stores will face a dramatically more competitive environment,” Petr Bena, Vice-Chairman of the Board of Alza.cz.

Barriers

Lower margins. Marketplaces operators charge a commission per sale made. The seller thus achieves a lower margin than if he sold the product for the same price on his online store. Especially when the seller decides to pay for advertising on the marketplaces. Thus, marketplaces can be seen as financial cannibalization, however, sellers often balance this barrier with the benefit of marketing promotions from marketplaces (see motivator above).

Loss of know-how. With entry into marketplaces and the associated increase in awareness of the marketer’s product, the risk of copying increases.

Loss of independence/control. Marketplaces operator gains access to sensitive information by facilitating sales. Theoretically, there is thus a risk of data leakage in his favour.

Brand exposure. Marketplaces generally erase brand power in purchasing decisions. Quality, uniqueness or other desirable product attributes come to the fore. According to David Cikánek from EXPANDO, 2 groups of sellers primarily sell on marketplaces: “The first group consists of private label manufacturers, however, foreign expansion via marketplaces is suitable for 2 out of 10 companies. The second group is resellers – statistically 4 out of 10 sellers are successful.”

Technical requirements. A moderate level of IT skills is required to run sales on marketplaces. For sales, the systems need to be paired correctly, the product feed needs to be uploaded, and there are also increased demands on accounting or administration in terms of analysing the right keywords depending on search queries, creating convincing product names and descriptions, or optimising photos and images, for example. Fortunately, however, there are a number of specialist companies on the market that will happily take over the management of your marketplace account for you. On our behalf, we recommend our long-term partner EXPANDO.

Income payments. Amounts earned from the sale of products are paid out of the marketplaces account at a certain frequency, usually once a month. This fact can pose existential problems for smaller companies.

Lack of demand. Marketplaces entry is no guarantee of growth. The product offering needs to be constantly optimised. If there is insufficient demand, this channel may be evaluated as ineffective.

Logistics. The entry into marketplaces is also linked to increased demands on logistics. Assuming a higher volume of orders, you will also be forced to adapt your warehouse space, equipment and processes to be able to maintain quality and the all-important customer experience. Are you able to adapt logistically to such growth? If you are hesitant, think about handing over your logistics to an external expert. At Skladon, we have been working with a number of clients selling on Amazon and other marketplaces since 2016 – see Skinners case study.

Start selling successfully on marketplaces today

From the above figures and trends, it is clear that the influence of marketplaces in e-commerce shopping will grow stronger in the Czech Republic. See marketplaces as an opportunity, not an enemy. By selling on marketplaces you can further build your brand and multiply your profits.

However, you need to approach the selection of the right marketplace responsibly. Different marketplaces have their own rules, vary in product categories, fee and commission structure, audience and competition. That’s why we recommend a deeper analysis and picking the most ideal channel depending on your product before entering. Last but not least, don’t underestimate your pricing strategy and logistics.

Do you see starting to sell on marketplaces as a complex task? Put your fears aside with us and our experience. We offer reliable solutions for individual areas.

First of all, we cooperate with EXPANDO, the leading Czech expert for effective sales on marketplaces. Take advantage of their know-how.

Are you worried about increased logistics requirements after the launch of marketplaces? Are you unsure of your warehouse, staffing and other capabilities? Do not hesitate to contact us. We currently have a distribution center with a warehouse area of 16,000 sq.m. with preparations for further multiple expansion. Among our clients you will find a number of successful retailers, for whom we have been handling orders from marketplaces in more than 180 countries since 2016.

Want to get a better idea of what it looks like in our distribution center? Watch our company tour video. Don’t hesitate to set off for expansion alongside a reliable partner.